The PILLAR Real Estate Fund

Professional Investment in Leased Locations by Arête & Associates and Regus

Position your capital ahead of the recovery curve.

Rebuilding Value Through Strategic Commercial Property Investment

From Distress to Distribution

Building Performance from Opportunity

The PILLAR Real Estate Fund brings together institutional discipline and entrepreneurial execution to capitalize on one of today’s most overlooked opportunities: the reset in commercial real estate.

At the core of the strategy is the acquisition of distressed commercial office buildings, often purchased 50–80% below market value. Through selective upgrades, improved leasing structures, and active management, these properties are repositioned into stable, high-yield assets designed to outperform as markets recover.

With $85.8 billion in distressed commercial real estate and 14.5% annual growth in flexible workspace demand, the PILLAR Real Estate Fund stands at the intersection of market dislocation and operational opportunity, capturing cash flow now and appreciation as markets recover.

The Trends Driving Our Strategy

Market Dynamics & PILLAR’s Principle

Three market forces are reshaping the commercial property investment landscape, and they’re exactly where the PILLAR Real Estate Fund is positioned to perform.

Deep Value in Office Assets

Flexible Office Demand

The RTO Momentum

The market is resetting, and PILLAR is already ahead of it.

The Right Markets. The Right Timing.

Strategic Market Selection

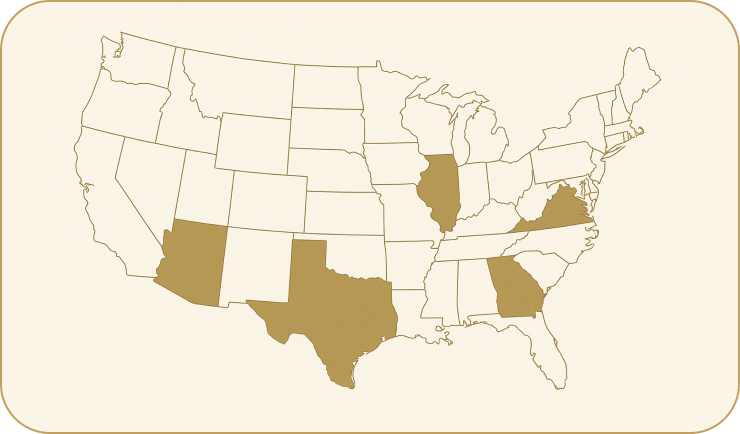

The PILLAR Real Estate Fund focuses on markets where people and businesses are moving — places with growing populations, supportive local policies, and strong job creation in high-value industries.

These regions combine steady economic growth, available office space ready for repositioning, and the right conditions for flexible workspace expansion, which are all key drivers in long-term commercial property investment growth.

$850 B+

combined office market value across target states

$2.5 B

serviceable obtainable market in qualifying distressed properties

$1.5 T

total CRE market in Texas alone

How We Create Value

An Adaptive Strategy Built for Precision and Agility

The PILLAR Real Estate Fund creates value through a disciplined, adaptive model that combines direct acquisitions with strategic lease positioning. The approach is designed to generate immediate income, preserve downside protection, and position assets for long-term appreciation.

Identify & Acquire

The fund targets distressed Class B/C office properties, typically purchased 20–40% below replacement cost, balancing income generation with appreciation potential.

In select cases, the fund secures long-term leases, with established tenants such as Regus covering 15,000–25,000 sq. ft., accompanied by a Right of First Refusal (ROFR) on the full property. This approach delivers day-one income while preserving flexibility to acquire once performance and timing align.

Immediate Activation

Each acquisition begins with 30–50% existing occupancy, providing a stable income base from day one.

Adding Regus as an anchor tenant—typically leasing 10–20% of the property—raises occupancy by 17–34% and strengthens visibility, rent stability, and asset value.

This rapid activation accelerates cash flow, diversifies tenants, and positions each property for growth as markets recover.

Long-Term Growth

As market conditions improve, stabilized assets compound investor returns through higher income and appreciation.

In direct acquisitions, properties mature into reliable income generators, while ROFR structures allow PILLAR to convert proven leases into ownership for additional upside.

As an evergreen, open ended fund, the fund enables reinvestment or periodic liquidity, aligning growth with evolving investor objectives.

The PILLAR Advantage

Exclusive Franchise Access

Through its partnership with United Flexible Offices (UFO), the fund benefits from an exclusive Regus franchise license, providing unmatched reach across key U.S. markets and the ability to activate flexible workspace centers with minimal competitive overlap.

Veteran Leadership

Management is guided by Russ Rosenzweig, a proven operator with a track record in high-return acquisitions, exits, and growth strategies. Arête & Associates, a leading real estate investment group, brings decades of performance discipline and investor-focused execution.

Operational Expertise

The management team delivers guaranteed tenancy activation through Regus centers, accelerating occupancy, stabilizing revenue, and enhancing property value. This ensures immediate income and sustainable commercial real estate ROI.

Strategic Precision

The PILLAR Real Estate Fund employs a dual-market approach: direct acquisitions of undervalued assets for appreciation, and lease-first strategies with Right of First Refusal (ROFR) to balance offensive opportunity with defensive flexibility.

Insider Access & Data Advantage

Leveraging Regus performance data, Round Table Group’s distressed asset network, and YPO relationships, the fund maintains a steady pipeline of high-quality, off-market opportunities. The fund is further supported by in-house brokers and analysts who provide deep market intelligence and deal flow visibility.

Fund Snapshot

$50M - 100M

Total Assets

15 - 20%

Target Yield

75%+

Occupancy Target

The Reset Creates Opportunity. PILLAR Captures It

Every cycle creates a window for disciplined capital. The PILLAR Real Estate Fund targets that moment, where distress turns into value and timing defines performance. We don’t wait for recovery; we build it.

Act with foresight, invest with purpose, and outperform the market recovery with PILLAR.

Frequently Asked Questions

1. What makes office real estate worth targeting right now?

Office is one of the last asset classes trading 40–60% below pre-pandemic valuations. While most sectors are priced for perfection, quality office assets remain heavily discounted. The PILLAR Real Estate Fund capitalizes on this market inefficiency by acquiring well-located buildings at deep value, securing income immediately, and positioning for appreciation as leasing demand recovers.

2. How does PILLAR mitigate downside risk in a volatile office market?

Risk is reduced at three levels: entry, structure, and operations. We buy below replacement cost, maintain low leverage, and focus on buildings already 30–50% occupied. Adding a Regus anchor tenant further stabilizes income and boosts visibility. This blend of existing occupancy, low debt, and active management provides resilience even in uneven markets.

3. What differentiates PILLAR from traditional value-add real estate investment funds?

Traditional funds often chase fully vacant or heavily leveraged deals. The PILLAR Real Estate Fund targets partially leased, income-producing assets where risk is already priced in. Our operators’ experience with tenant activation and flexible leasing allows faster stabilization and earlier distributions. As an evergreen fund, it compounds investor capital across cycles rather than winding down at a fixed term.

4. How do you underwrite return expectations in a resetting market?

We model conservative cash yields and appreciation assumptions based on current rental comps, occupancy trajectories, and cap rate normalization. Typical underwriting targets double-digit IRRs derived from a combination of stabilized cash flow and appreciation as properties are revalued closer to replacement cost.

5. What’s the liquidity profile for investors?

As an evergreen fund, PILLAR provides periodic redemption windows and optional reinvestment of distributions. This allows investors to manage exposure and compound over time, offering more flexibility than traditional closed-end vehicles without compromising portfolio stability.

6. How are assets sourced and evaluated?

All acquisitions originate from direct relationships with brokers, lenders, and regional operators specializing in distressed or underperforming office portfolios. Each opportunity undergoes rigorous financial, physical, and market due diligence before execution, ensuring assets meet strict yield-on-cost and tenant-demand criteria.

7. What’s the role of Regus within the leasing strategy?

Regus acts solely as a tenant, not a partner or subsidiary. Their leases, typically 10–20% of the building, provide steady occupancy, daily foot traffic, and credibility for other tenants. The PILLAR Real Estate Fund’s relationship with Regus franchise operators helps secure these leases quickly, creating early income without tying fund equity to the Regus brand.

8. How does PILLAR generate income before full stabilization?

We target buildings with 30–50% in-place occupancy, which immediately contribute rent. As Regus and other tenants are added, cash flow increases and property values rise. This dual-income structure, existing leases plus new anchors, creates a faster path to positive yield and mitigates the “dead capital” lag common in ground-up or vacant repositioning projects.

9. How do you plan for refinancing or exit in a higher-rate environment?

Because our acquisitions are low-leverage or debt-free, we have the flexibility to refinance only when conditions are favorable. As markets normalize, stabilized assets can be recapitalized at improved valuations or selectively sold to institutional buyers seeking stabilized yield. This conservative, flexible approach to commercial property investment protects both income and capital.

10. What’s your track record and operational experience in this model?

The fund’s management team, led by Russ Rosenzweig, has executed multiple profitable office repositioning projects and Regus-anchored leases across Chicago, California, and Nevada, achieving occupancy levels of 90%+ and CAGRs exceeding 100% on proof-of-concept properties. The fund now scales that same model nationally, applying institutional discipline to an operator-tested playbook.